Today, small pharma companies are overwhelmingly driving innovation, accounting for 63% of all new prescription drug approvals over the past five years.

The pharmaceutical world is vast, with each company carving its unique path based on research priorities, market dynamics, and operational capabilities. Among the myriad of players, Vanguard companies – small, nimble, innovative entities – often display contrasting strategies compared to their larger Pharma counterparts. A deep dive into recent data reveals intriguing patterns in research areas and clinical trial recruitment. This article seeks to shed light on these distinctions and understand the driving forces behind them.

Diverging Research Interests: Neoplasms vs. Rare Diseases & General Pathology

Observations:

- Vanguard companies are notably inclined towards neoplasm research.

- Other pharmaceutical firms show a pronounced focus on symptoms/general pathology and rare diseases.

Potential Insight & Reasons

- Market Potential & Return on Investment:

- Neoplasms: Neoplastic conditions (like cancers) affect a large population worldwide, and treatments in this domain often command high prices. Vanguard companies, who are often burdened with high ROI expectations by their funding partners, might be incentivized to tap into this lucrative segment. Moreover, in the realm of therapeutic research, oncology consistently garners substantial financial backing. For emerging pharmaceutical enterprises reliant on external venture capital investment, the oncology sector presents a promising avenue for exploration and potential funding opportunities.

- Symptoms/General Pathology & Rare Diseases: Larger pharma companies might be focusing on symptoms and general pathology because treatments addressing these areas could cater to a wide patient base across various diseases. As for rare diseases, the pricing model often allows for high-priced treatments due to the uniqueness of the condition and lack of alternative treatments. Given the robust clinical evidence, demonstrated cost-effectiveness, and the potential for orphan drug designation, both of these therapeutic areas exhibit a higher likelihood of securing reimbursement advantages, subsequently reducing the financial burden on patients.

- Operational Capabilities & Resources:

- Vanguard Companies: Exploring neoplasms might require specialized expertise but might not always demand the vast infrastructure that bigger firms maintain. Vanguard companies might find it more feasible to operate and innovate within this realm, as the success often depends on the agility of these lean organizations and their ability to shift the resources and focus towards promising outcomes.

- Other Pharma Companies: Investigating symptoms/general pathology and rare diseases could demand substantial resources, extensive patient databases, and long-term commitment. Larger firms, with their vast infrastructure and deep pockets, can handle such demands.

- Regulatory & Strategic Considerations:

- Vanguard Companies: A significant consideration for many emerging pharmaceutical and biotechnological firms is their exit strategy. By concentrating their research and specialization in niche therapeutic areas, these entities enhance their appeal as potential acquisition targets.

- Other Pharma Companies: Rare diseases often come with regulatory incentives, such as orphan drug status, faster approvals, and extended patent protections. Larger pharma companies might be in a better position to capitalize on these incentives due to their robust regulatory teams and long-term strategies.

- Collaboration & Partnerships:

- Vanguard Companies: As mentioned above, Vanguard companies’ focus on neoplasms might make them attractive partners for larger firms looking to expand their oncology portfolio through acquisitions or collaborations.

- Other Pharma Companies: Their extensive resources allow them to engage in multiple partnerships and collaborations, helping them access a diverse range of potential treatments for symptoms/general pathology and rare diseases.

- Public Image & Social Responsibility:

- Vanguard Companies: To differentiate themselves in a crowded market, these smaller entities might be focusing on specific neoplasms where innovative approaches can lead to breakthrough treatments, assuring themselves a good PR.

- Other Pharma Companies: Addressing rare diseases often comes with positive public relations outcomes, portraying the company as one that caters to underserved patient populations. This commitment not only serves a social good but can also enhance the company’s public image.

Clinical Trial Recruitment Dynamics: A Study in Contrasts

Observations:

- Vanguard Companies:

- From 2021 to 2022, there was a decline in ‘active but not recruiting’ studies (from 656 to 266) but an increase in ‘recruiting’ studies (from 1481 to 1999).

- Other Pharma Companies:

- From 2021 to 2022, there was a significant decline in ‘active but not recruiting’ studies (from 893 to 356) but a relatively minor increase in ‘recruiting’ studies (from 3501 to 3623).

Potential Insights & Reasons:

- Completion rates of Studies:

- Vanguard Companies: The reduction in ‘active but not recruiting’ alongside an increase in ‘recruiting’ suggests these companies might have completed many of their previously active studies and are initiating new ones. This efficiency in completing the studies can be partially explained by the heightened pressure on small biotechs to establish impeccable CRO and vendor partnerships from inception, as unlike larger pharmaceutical counterparts with more extensive financial resources, these diminutive entities are highly sensitive to clinical trial timeline delays, out-of-scope change orders, and cost overruns, with a single flawed clinical trial potentially jeopardizing their entire operation.

- Other Pharma Companies: The significant drop in ‘active but not recruiting’ indicates that many studies might have either progressed to the next phase or have been concluded. The small increase in ‘recruiting’ studies may suggest that they are either slower in initiating new studies or are focusing more on progressing existing ones.

- Operational Efficiency & Resource Allocation:

- Vanguard Companies: The notable rise in ‘recruiting’ studies might be influenced by the ever increasing funding going towards biotech sector. Just as a reference, “in 2010, there was $1.1 billion with 152 deal counts, which is in stark comparison to the $10.4 billion and 556 deals by Q3 of 2019, with the largest amount of funding focused on earlier stage healthcare companies” – PharmaVoice.

Moreover, small and emerging pharma companies, once predominantly reliant on VC funding, have recently benefited from new trend of synergies with Big Pharma, which now financially supports many of these smaller entities specializing in niche research areas.

Moreover, small and emerging pharma companies, once predominantly reliant on VC funding, have recently benefited from new trend of synergies with Big Pharma, which now financially supports many of these smaller entities specializing in niche research areas.

- Vanguard Companies: The notable rise in ‘recruiting’ studies might be influenced by the ever increasing funding going towards biotech sector. Just as a reference, “in 2010, there was $1.1 billion with 152 deal counts, which is in stark comparison to the $10.4 billion and 556 deals by Q3 of 2019, with the largest amount of funding focused on earlier stage healthcare companies” – PharmaVoice.

-

- Other Pharma Companies: The relatively stable number of ‘recruiting’ studies between the two years might suggest a sustained, steady strategy without aggressive expansion. This also reflects the lack of the pressure that smaller pharma and biotech companies experience, as the lack of efficiency is not so severely punished. Moreover, these entities might have a more extensive and complex decision-making process, potentially making them slower in initiating new trials.

Conclusion

The world of pharmaceuticals, with its multifaceted challenges and opportunities, is a dance between strategy, market forces, and adaptability. The patterns displayed by Vanguard and Larger Pharma companies offer a captivating glimpse into the current dynamics of drug development. As these companies continue to shape the future of healthcare, tracking these divergences will remain crucial.

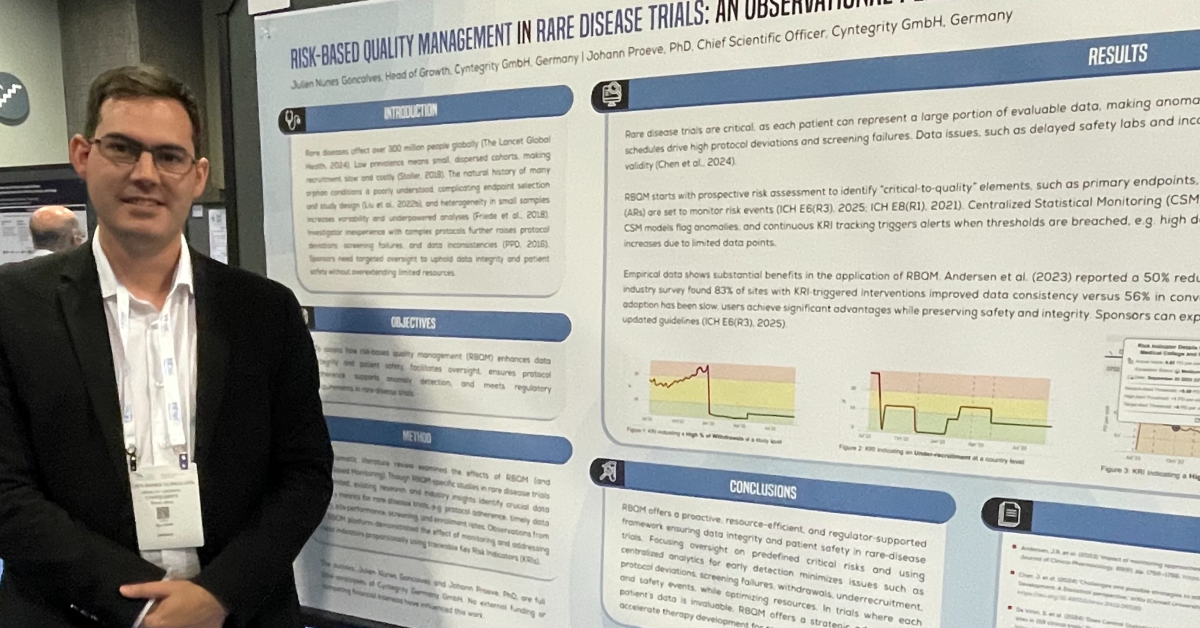

In addition to exploring research interests and recruitment dynamics, the pharmaceutical industry focuses on strategies like analyzing clinical trial pipelines and making critical M&A decisions. An essential tool in this context is Cyntegrity’s MyRBQM Portal, which employs AI for intelligent oversight. This tool offers insights, benchmarking, and regulatory compliance for clinical trials. M&A activities are also crucial for growth, necessitating careful clinical trial data accuracy and compliance assessment. The MyRBQM Portal aids both buyers and target companies in this process, enhancing value propositions and facilitating smoother transitions. Professional services in these areas are becoming increasingly vital. Ultimately, embracing tools like the MyRBQM Portal and specialized services enables pharmaceutical entities to remain agile, compliant, and well-informed in a rapidly evolving industry, ensuring growth and a strong market presence. Learn more…